As we delve into the various routes in Previous Post of this Investment Series, it becomes evident that each route entails specific costs in terms of time, money, effort, and risks.

Among these costs, ‘Time’ holds paramount significance as it greatly influences your business’s profitability. This article is dedicated to understanding the Cashflow Timeline associated with this aspect.

While we won’t be examining every detail, we will provide a concise overview of the basic cashflow timeline.

In the preceding post, we explored 8 different routes. For simplicity’s sake, we will illustrate 2 of these routes in order to offer you a clearer comprehension of the timelines. By extrapolating from these examples, you can also discern the timelines for the remaining 6 routes.

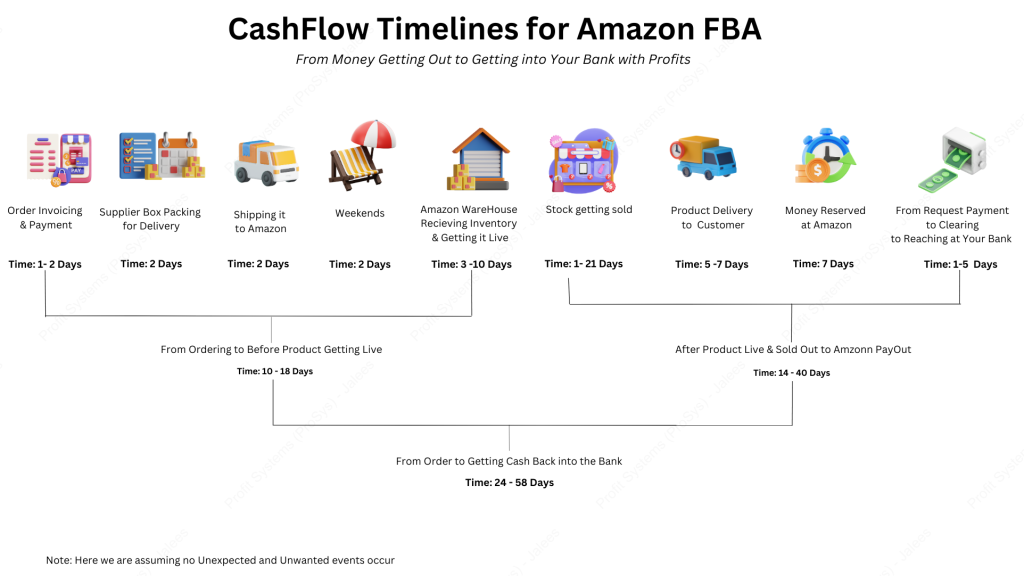

✅ Route — 1:

🚚 Route: Supplier to Amazon

📦 Packaging: Boxes only

🚛 Shipping: Third-party or Amazon Shipping

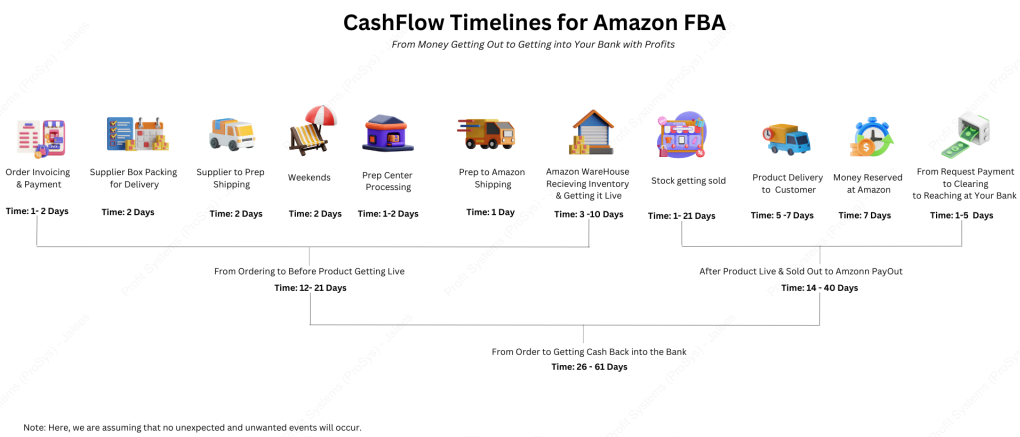

✅ Route — 2:

🚚 Route: Supplier to Prep Center to Amazon

📦 Packaging: Boxes exclusively

🚛 Shipping: Third-party or Amazon Shipping

Note: For Pallet Shipments you can add around 5 days more in the timeline, but pallet shipment is also saved you money.

As you can observe, each investment cashflow cycle requires a certain amount of time to complete. Consequently, to determine monthly and annual profitability, you can utilize the estimated timelines provided above.

Cashflow Timelines and Profitability:

Based on the cashflow timeline provided, an ROI of approximately 15% could yield around $1,500 per month from an investment of $20,000. It’s important to note that these figures serve as estimates for illustrative purposes, and fluctuations in profit and loss are inherent to the nature of the business.

I trust this article has provided you with a comprehensive understanding of the cashflow timeline in the Wholesale/Retail Business, along with potential expectations for profitability.

In the upcoming articles, we will delve deep into the different costs and timelines. If you optimize these factors for your business, it can significantly enhance your business’s profitability.

Note: Do you want to know how to measure your investment performance over time, take a look at this important article. In it, we explain why ROI is a more accurate metric for measuring investment performance over time as compared to Margin: The Magic of ROI: Why Your Investment’s True Power Isn’t in the Margins ✨📈